HOA Reserve Study: The Complete Guide for Community Associations

September 15, 2025 - Stuart WIlkinson

PropFusion connects you with a vetted network of Reserve Study experts in your state, ensuring best industry standards.

If you sit on an HOA or condo board, you cannot dodge reserve studies forever.

Lenders expect them. Buyers and regulators increasingly look for them. Several states now require them by law, and national standards from Community Associations Institute (CAI) and the Association of Professional Reserve Analysts (APRA) define what a professionally prepared reserve study should include.

This page is your main hub for everything related to HOA reserve studies:

- What a reserve study actually is

- Why it matters for your community’s risk and property values

- What different types (levels) of reserve studies exist

- Typical cost ranges and how they vary by state

- Legal and regulatory expectations

- How to use reserve studies in day-to-day decision-making

Throughout the article you will see pointers to deeper guides on specific topics (for example: rules of thumb, funding methods, study levels, costs, laws by state). Those are separate articles you can open when you’re ready to go deeper.

What Is an HOA Reserve Study?

In simple terms, an HOA reserve study is a professional analysis that:

- Identifies your association’s major common-area components (roofs, paving, siding, decks, elevators, pools, clubhouses, etc.)

- Estimates when those components will need major repair or replacement

- Forecasts the long-term cost of those projects

- Recommends how much your association should set aside each year to be ready for them

CAI and APRA define a reserve study as having two core parts: a physical analysis of the common elements and a financial analysis of the reserve fund and funding plan.

State and regulatory resources describe it similarly. Colorado’s Department of Regulatory Agencies, for example, calls a reserve study “an examination conducted by a reserve specialist, consultant or accounting firm for the purpose of analyzing any probable long-term expenses” and using that analysis to estimate reserve needs as accurately as possible.

Why Reserve Studies Matter

Reserve studies sit at the intersection of risk management, property value, and board governance.

Financial stability

A good reserve study gives you a realistic roadmap for long-term capital projects. It reduces the odds of nasty surprises—special assessments, emergency loans, or deferred projects that become more expensive later.

Property values and marketability

Buyers and lenders increasingly ask whether a community has current reserve studies and adequate funding. Fannie Mae, for example, looks at reserve planning and contributions when underwriting certain condominium loans.

Legal and fiduciary duty

Boards are expected to plan ahead for predictable major repairs and replacements. In some states, that expectation is written directly into statute through reserve study and disclosure requirements. CAI’s summary of state reserve fund laws shows just how many jurisdictions now mandate reserve planning or regular updates.

Transparency with owners

A clear reserve study makes it easier to explain assessment levels, justify increases, and show owners that the board is managing the community’s largest financial asset—the reserve fund—responsibly.

If you want a focused discussion on the dangers of underfunded reserves and how to dig out of a hole, see “Underfunded Reserves: Risks and Recovery Plans”.

Key Decisions Every Board Has to Make

Once you commit to getting a reserve study, several crucial decisions follow. Each of these has its own in-depth guide.

How much should we keep in reserves?

Boards want a straight answer on “how much is enough.” In professional standards, that concept is captured by Fully Funded Balance (FFB) and Percent Funded:

- FFB is the ideal reserve balance at a point in time, based on the depreciated cost of all components.

- Percent Funded compares your actual (or projected) balance to that ideal.

CAI’s standards define “fully funded” reserves as a situation where the actual reserve balance equals the Fully Funded Balance—i.e., 100% funded.

In practice, reserve specialists often talk in ranges: for many communities, somewhere around 70–100% funded is considered strong, while very low Percent Funded levels signal higher risk of special assessments.

For a practical overview of benchmarks and rules of thumb, see “HOA Reserves Rule of Thumb: How Much to Keep”.

What does “fully funded reserves” actually mean?

“Fully funded” sounds like a slogan, but it is a precise technical concept that flows from the National Reserve Study Standards. It does not mean “we’ll never need a special assessment,” and it does not mean having a random round number in the bank.

Our dedicated article can walk through:

- How Fully Funded Balance is calculated from component data

- How Percent Funded is derived

- Why being under 30–40% funded is generally considered high risk in many communities

See “What Does Fully Funded Reserves Mean?” for a detailed explanation and examples.

Which funding method will we follow?

Using the same reserve study, a board can choose different funding objectives, such as:

- Full Funding – targeting 100% of the Fully Funded Balance over time

- Threshold Funding – staying above a defined floor

- Baseline Funding – avoiding a zero balance but accepting more volatility

These approaches are recognised in CAI’s standards and widely discussed in industry best practice documents.

The choice affects:

- Assessment stability

- Risk of future special assessments

- How quickly you move toward “fully funded”

What type or level of reserve study do we need?

Not every reserve study has the same scope. CAI’s standards and most large providers define several levels of service, typically framed as:

- Full Reserve Study with site visit and full component inventory

- Update with site visit

- Update without site visit (desktop update)

The right level depends on your situation:

- New community or no credible existing study → full baseline study

- Existing study that’s 3–5 years old → update with site visit

- Recent site-visit study, no major changes → desktop financial update

See “The 3 Types of Reserve Studies (Levels I–III)” for a deep dive into when each approach is appropriate.

Who should we hire to conduct the study?

Most state laws do not spell out a specific license, but national credentials and best practice matter. Two widely recognised credentials for reserve professionals are:

- Reserve Specialist (RS) – administered by CAI

- Professional Reserve Analyst (PRA) – administered by APRA

Well-known HOA law firms, such as Adams Stirling in California, explicitly point to RS and PRA as evidence of competence for reserve study professionals.

For guidance on selection criteria, RFPs, and interview questions, see “Who Conducts an HOA Reserve Study?”.

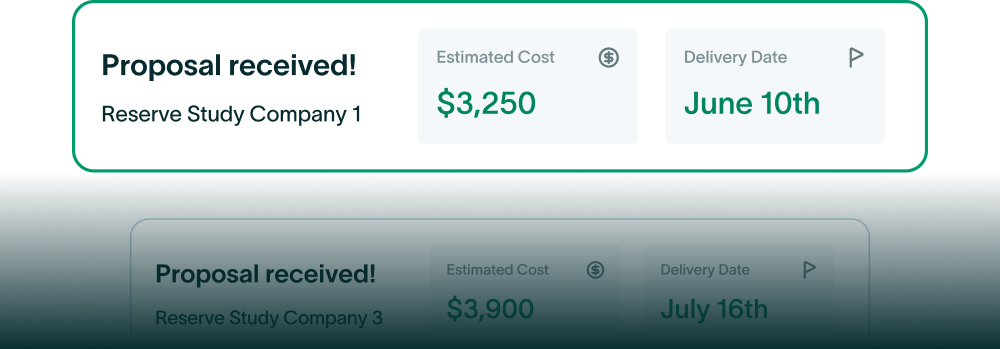

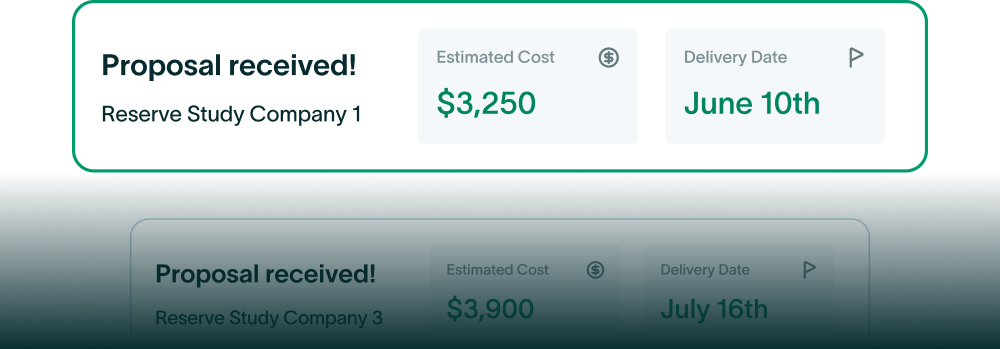

How much will the reserve study cost?

Costs depend heavily on:

- Community size and complexity

- Study level (Full vs Update with or without site visit)

- Region and market rates

- Scope of analysis and number of scenarios requested

We wrote an in-depth article on How Much Does a Reserve Study Cost.

How often should we update our reserve study?

Best practice is to treat reserve studies as a living planning tool, not a one-time box-check.

Many statutes now specify update cycles. For example:

- Washington law, for example, requires reserve studies for certain communities, annual updates, and a site-visit update at least every three years.

- Virginia guidance requires boards to review reserve study results at least annually to determine if reserves are sufficient and adjust contributions as needed.

- Maryland’s newer law requires community associations to obtain an independent reserve study and update it at least every five years.

View our complete guide to Reserve Study Laws and Requirements in all 50 states.

How an HOA Reserve Study Is Done: Process Overview

Reserve studies can feel mysterious from the outside. In reality, most professional firms follow a fairly standard process grounded in CAI and APRA standards.

Information gathering

The provider will request:

- Governing documents and plats/plans

- Recent budgets and financial statements

- Prior reserve studies and engineering reports

- Maintenance histories and large project invoices

- Any planned projects or known issues the board or manager is aware of

This step defines what the association is responsible for, which components to include, and what constraints exist (for example, limits on dues increases).

Site visit and component inventory

For a Full or Update with Site Visit study, the analyst performs a site inspection to:

- Inventory major common-area components

- Observe condition and signs of wear

- Confirm quantities and locations

The result is a component inventory—the foundation of every reserve study—listing each component, quantity, estimated remaining life, and current replacement cost.

Costing and life estimates

Using contractor pricing, cost databases, prior bids, and professional judgment, the provider estimates:

- Total replacement cost (labour, materials, access)

- Total useful life

- Remaining useful life

These inputs flow directly into the calculation of Fully Funded Balance and the timing of future expenditures.

Financial modeling

The provider then builds a long-range financial model, typically 20–30 years, that:

- Projects reserve fund inflows (contributions, interest income)

- Projects outflows (scheduled repair and replacement projects)

- Tests different funding objectives and contribution paths

CAI’s updated standards now expect studies to cover at least a 30-year period, reflecting long component lives like roofs, façades, and infrastructure.

The output usually includes:

- Cash-flow charts

- Percent Funded projections

- Recommended annual or monthly contribution levels

- Notes on any years where special assessments might still be needed under certain scenarios

Reporting and board discussion

A professional reserve study report normally includes:

- An executive summary in plain language

- The detailed component list and assumptions

- Funding plan(s) with graphs and tables

- Disclosures and limitations, including what is outside the scope of the study (for example, destructive testing or structural engineering analysis)

Boards should not treat this as a static document. A companion guide like “How to Read and Use Your Reserve Study” can help directors turn the report into specific decisions on assessments, project timing, and owner communication.

What Do HOA Reserve Studies Typically Cost?

Actual quotes will vary, but several patterns hold across the industry:

- Small HOAs with simple common areas and limited amenities typically pay on the lower end.

- Larger, complex communities (multi-building condos, high-rises, resort-style associations) pay significantly more due to the scope of inspection and modeling.

- Full baseline studies cost more than updates, and updates with site visits cost more than desktop updates without site visits.

If you want to focus specifically on the consequences of underfunding and how to get back on track, you can use a separate guide such as “Underfunded Reserves: Risks and Recovery Plans”.

HOA Reserve Study Requirements and State Laws

There is no single federal standard, but reserve planning has been moving steadily from “best practice” to legal requirement in many jurisdictions.

Your state may impose specific obligations on whether you must have a reserve study, who can prepare it, and how often it must be updated. Boards should check their state’s page and, where necessary, consult with association counsel.

Who Prepares HOA Reserve Studies?

A reserve study is only as good as the assumptions and judgment behind it.

Most associations hire outside specialists rather than trying to do this in-house. CAI and APRA both maintain directories of member firms and credentialed professionals.

Key things to look for include:

- Experience with communities similar to yours (size, building type, climate)

- Familiarity with CAI National Reserve Study Standards and APRA Standards of Practice (link to CAI Reserve Study Standards) (link to APRA Standards of Practice)

- Recognised credentials such as RS and PRA (link to CAI Reserve Specialist designation page) (link to APRA PRA credential page)

- Clear, readable sample reports, not just technical output

- A proposal that specifies level of service, site visits, assumptions, and deliverables

Latest HOA Reserve Study Guides for HOAs and Condos

PropFusion connects you with a vetted network of Reserve Study experts in your state, ensuring best industry standards.

Take the guesswork out of choosing a reserve study company

PropFusion connects you with a vetted network of Reserve Study experts in your state, ensuring best industry standards.